Integrated Reporting and the Investor Demand for Materiality

Last week I published a paper “The Investing Enlightenment: How Principle and Pragmatism Can Create Sustainable Value through ESG” with Mirtha Kastrapeli, head of Sustainable Investment Research at State Street’s Center for Applied Research (CAR). This paper was based on a global survey of 582 institutional investors evenly split between asset owners and asset managers and equity and fixed income, all of whom were or were planning to practice some type of ESG investing; and 750 retail investors, including some who were not practicing ESG investing.

The results were very interesting and strongly support the importance of integrated reporting. We found that the commonly cited barriers to ESG integration, a type of ESG investing in which there is a full and systematic incorporation of ESG risk and opportunities in the investment decision making process, among this group of investors are not as great as commonly believed, In particular, only a minority of them are concerned that incorporating ESG factors can hurt financial performance, very few (10 percent) see the fiduciary duty of fund trustees as precluding ESG integration (with around 45 percent seeing a trend of not doing so as a violation of fiduciary duty), and investors are realistic about the times frames (75 percent of institutional investors expect outperformance in three years or more and 45 percent in five years or more).

Yet one big barrier stands out: the lack of standardised, high-quality data on ESG performance. One-half (53 percent) of institutional investors complain about the lack of ESG data reported by companies and 60 percent are concerned about the lack of standards for measuring ESG performance. These numbers for retail investors are 46 percent and 39 percent, respectively. Institutional investors aren’t standing still; two-thirds of them are engaging with their portfolio companies to get this information.

But what information do they want? Every company faces a vast range of ESG issues of concern to its many stakeholders. Not all of these are of interest to investors. They are interested in the material ones as defined by “The International <IR> Framework.”

Relevant matters are those that have, or may have, an effect on the organization’s ability to create value. This is determined by considering their effect on the organization’s strategy, governance, performance, or prospects.

Our survey provides dramatic support for the importance of materiality. A remarkable 92 percent of institutional investors want companies to identify what they consider to be the material ESG issues and to report on their performance on them. In other words, investors want the company’s view of materiality which they can match with their own and this provides the basis for engagement. We also found that two-thirds of investors believe that it is possible to create models that show the relationship between material ESG issues and financial performance. An integrated report is the perfect place for companies to clearly identify what they consider to be their material ESG issues, how these are factored into the company’s strategy, and what the current and expected financial performance is from effective management of these issues.

But who should determine which issues are material? Again, our survey yielded some dramatic results. Two-thirds of institutional investors want the board of directors to determine this. This provides strong support for the idea of an annual board “Statement of Significant Audiences and Materiality.” Respondents were given multiple choices to this question. Only 32 percent cited the CEO (less than the 39 percent who cited the Chief Sustainability Officer). Tellingly, only 14 percent cited the CFO or Head of Investor Relations, clear market feedback that the finance function has yet to grasp the importance of material ESG issues in creating value. Since an integrated report cannot be created without input from the finance function, it is a way to get CFOs up the learning curve on ESG—not all ESG issues, but the ones that matter to value creation.

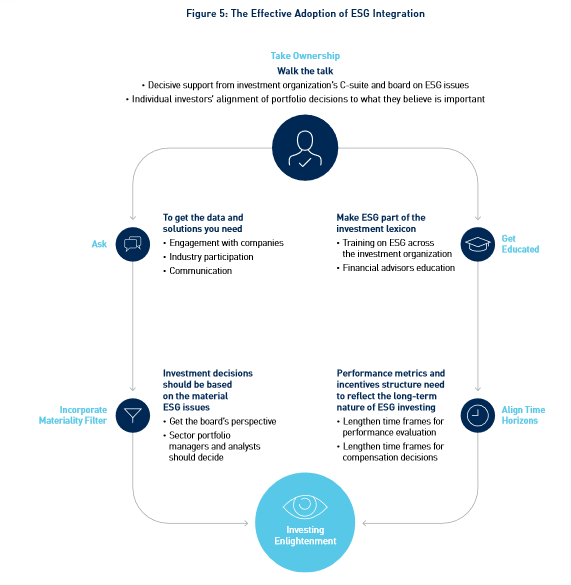

To improve the degree and quality of adoption of ESG integration by investors, we offer a simple five-element model, shown below. Integrated reporting can play an essential role in the elements of “Ask” and “Incorporate Materiality Filter.” Investors should ask their portfolio companies to provide an integrated report, including a board “Statement of Significant Audiences and Materiality” and explicitly identifying what the company regards are its material ESG issues. Investors can use this as input to forming their own view to incorporate a materiality filter.

As Mirtha and I conclude in our paper, full ESG integration can lead to the creation of value for both investors and for society as a whole. This starts with value creation by portfolio companies, added by integrated reporting and the integrated thinking it brings about. By asking companies to provide integrated reports, investors are helping both companies and themselves.