Securing the future of business: Assessing banks' natural capital risk exposure

It can be hard to identify, assess and mitigate the natural capital risks present in many banking portfolios. Here is a guide – Integrating natural capital into risk assessments – developed by PwC and the NCFA, to help banks cut through the complexity and get an initial understanding of their natural capital risk exposure.

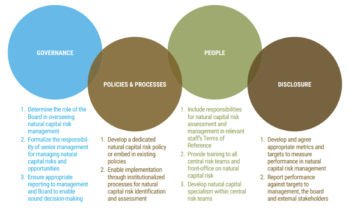

Those who embed natural capital thinking (a key element of integrated thinking) into their organisational culture – with the aid of strong governance, clear processes and well-informed teams – are the most likely to succeed at managing and mitigating natural capital risks and identifying related opportunities.

As with any other material risk, financial institutions need to integrate natural capital risk management into their wider enterprise risk management frameworks at the asset, client and portfolio levels.

The guide takes banks step by step through a rapid natural capital risk assessment, which is designed to help any bank:

- Improve their foresight by uncovering risks that they were previously unaware of

- Expose systemic risks in bank portfolios that would not have been detected in individual transaction assessments

- Monitor the evolution of natural capital risks and their potential impact on borrowers in the future

The guide, which was co-developed by a PwC team led by sustainability and climate change partner Jon Williams, includes a recommended risk management framework to help with next steps (see illustration).

Pillars of a successful risk management

Given the increasing erosion of natural capital and the increasing risks that businesses and their financiers face, this report is a timely addition to the tools available to risk managers who want to quickly get a sense of natural capital risk in their portfolios. The approach has been piloted by banks in three countries and so provides a tested risk management framework that can be readily adopted.

For further information, please contact Alan McGill ([email protected]), Jon Williams ([email protected]) or Marie-Justine Labelle ([email protected]) at PwC.