Strengthening an integrated report using SASB Standards

Markets increasingly recognise that the ability of business to create value relies on more than financial capital alone. For proof, look no further than the growing gulf between a typical firm’s enterprise value and the net assets on its balance sheet.

A major driver behind the International Integrated Reporting Council (IIRC) and Sustainability Accounting Standards Board (SASB) plans to merge into a unified organisation, the Value Reporting Foundation, is to address this gap – enabling companies to report on the range of resources and relationships they use to create value.

Across the globe, increasing numbers of organisations are leveraging the complementary benefits of the International Integrated Reporting Framework and SASB Standards, such as Itaú Unibanco, Arcelor Mittal, CEMEX, Diageo, TEPCO, and SK Telecom.

Together, the International <IR> Framework and SASB Standards provide a more complete picture of long-term enterprise value creation, while meeting investor needs for comparable, consistent and reliable information.

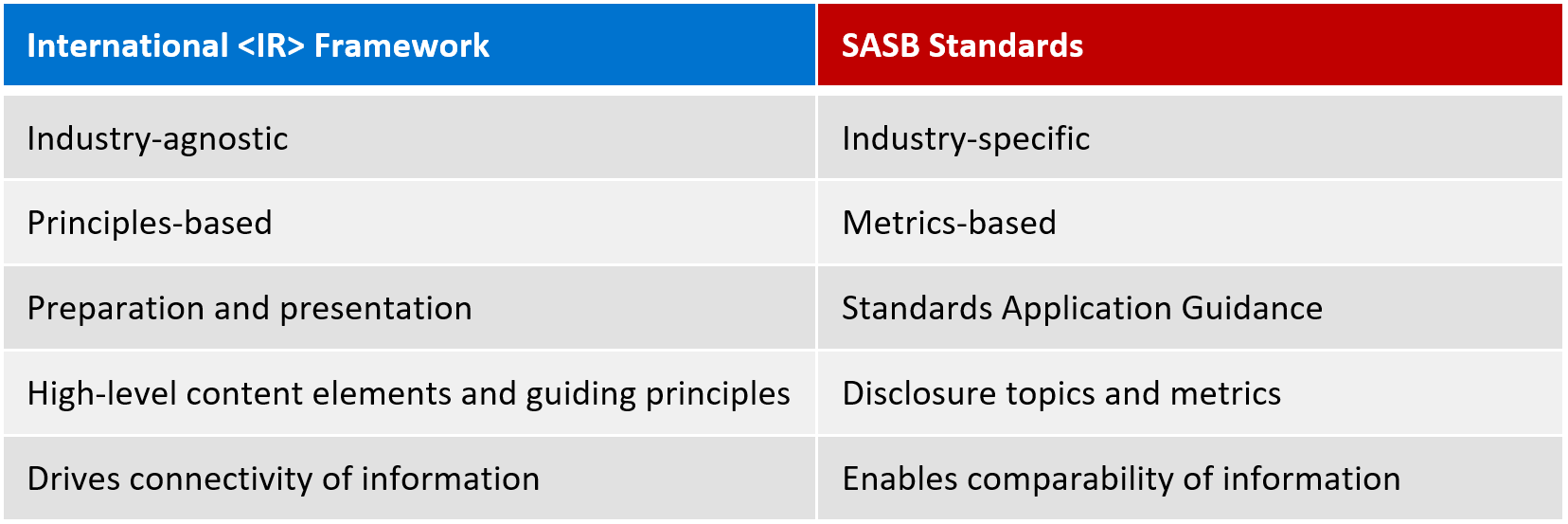

Much of the complementarity of the <IR> Framework and SASB Standards can be attributed to the inherent purpose of ‘frameworks’ and ‘standards’ for disclosure. Frameworks provide a set of (often) industry agnostic, principles-based guidance for how information is structured and prepared and which broad topics are covered. Whereas standards often offer industry-specific, replicable and detailed requirements for what should be reported for each topic.

The <IR> Framework drives a holistic view of the value creation process through governance and business model disclosure, and the connectivity of information, while SASB Standards add comparability to sustainability-related data across peer companies. Notably, both the <IR> Framework and the SASB Standards were designed to ease the burden of disclosure. Where possible, they align with existing data, reports, and processes to generate better—not necessarily more—information for report users.

A more holistic view of value: The ‘how’

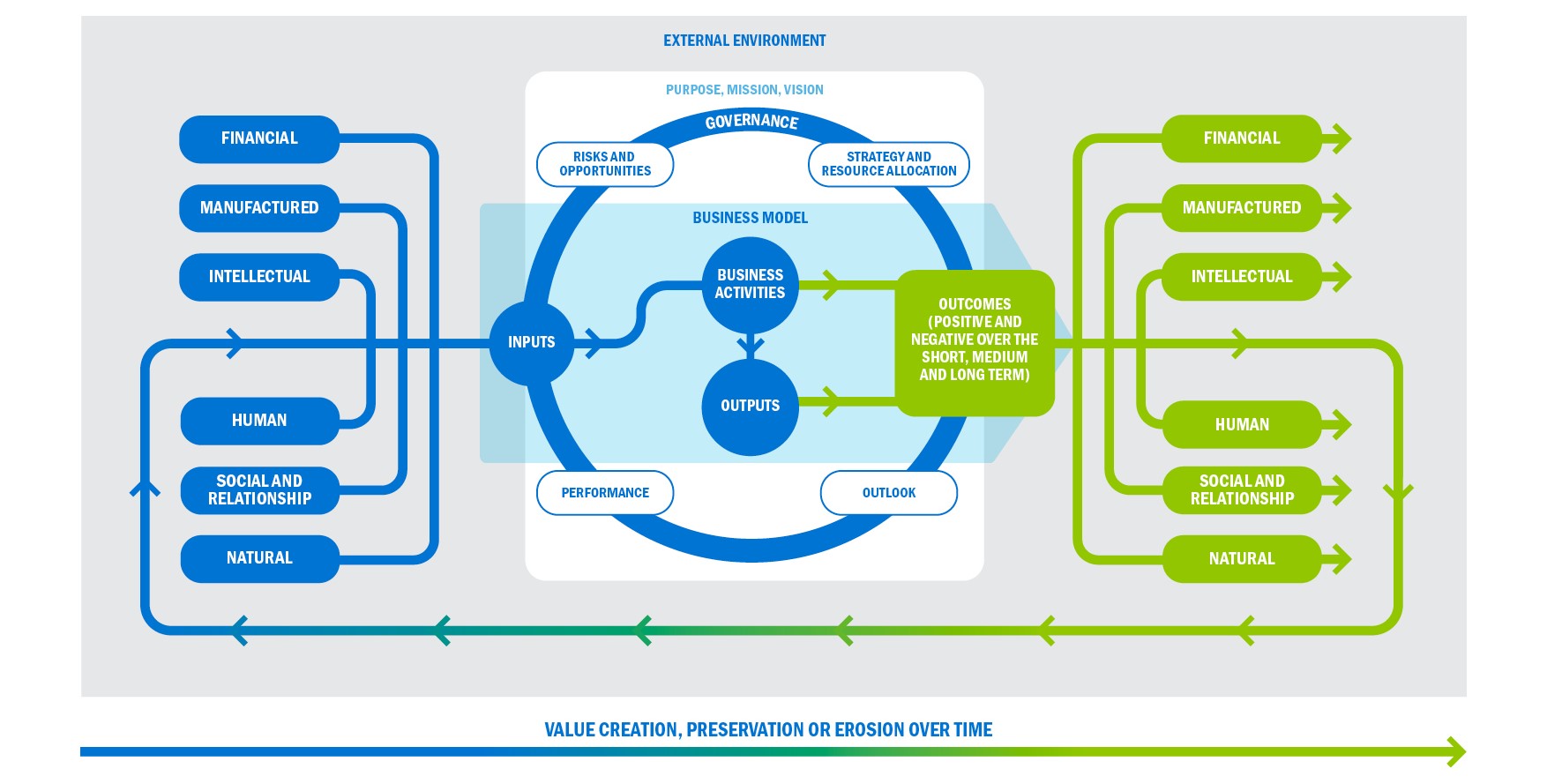

The <IR> Framework offers an evolved way of thinking about long-term value creation. An integrated report is a concise communication about how an organisation’s strategy, governance, performance and prospects, in the context of its external environment, lead to the creation, preservation, or erosion of value over the short, medium, and long term.

Quantifying and comparing performance: The ‘what’

SASB Standards provide industry-specific disclosure topics and metrics, lending insight into the subset of sustainability issues that are most closely tied to a company’s ability to create long-term value for investors.

The Standards address sustainability-related risks and opportunities reasonably likely to affect a company’s financial condition (i.e. its balance sheet), operating performance (i.e. its income statement), or risk profile (i.e. its market valuation and cost of capital).

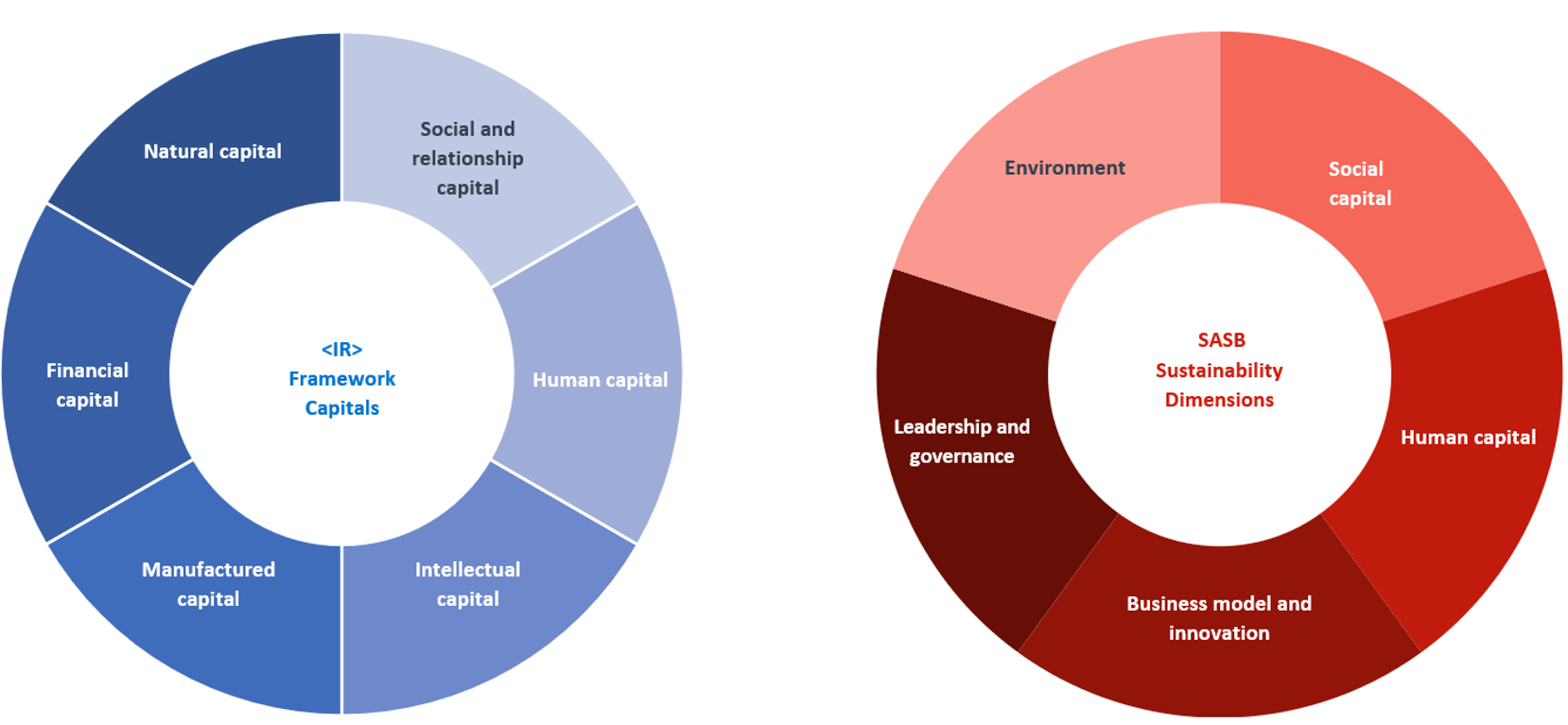

To increase understanding of how the <IR> Framework and SASB Standards complement one another, we mapped alignment between the six capitals outlined in the <IR> Framework and SASB’s five sustainability dimensions.

What are the <IR> Framework’s six capitals?

Fundamental to integrated reporting is the concept of ‘multi-capitalism’ – that all organisations depend on various forms of capital for their success. The capitals are stocks of value (or resources and relationships) on which all organisations depend for their success as inputs to their business model (as depicted in the diagram below), and which are increased, decreased or transformed through the organisation’s business activities and outputs. The capitals are categorised as financial, manufactured, intellectual, human, social and relationship, and natural. An integrated report drives connectivity of information between all of the capitals.

What are SASB’s five sustainability dimensions?

SASB organizes the universe of sustainability risks and opportunities into sustainability dimensions, also known as the ‘universe of sustainability issues.’ This provides a structure for SASB’s industry-specific Standards. The five sustainability dimensions are categorised as environment, social capital, human capital, leadership and governance, and business model and innovation. The dimensions are refined further into 26 general sustainability issues.

Close alignment between the <IR> Framework’s capitals and SASB sustainability dimensions

In the latest report published by CDP, CDSB, GRI, the IIRC and SASB, sustainability matters was defined as all value drivers represented by the capitals in the <IR> Framework, with the exception of financial capital. Currently, mapping these five capitals to SASB’s sustainability dimensions reveals that SASB Standards already provide industry-specific disclosure topics and metrics for four of the five capitals, enabling industry-specific content for an integrated report.

In the future, SASB Standards will likely evolve to ensure businesses can provide metrics and data on all of the five capitals to drive robust reporting. Over time, we plan to merge the <IR> Framework’s capitals and SASB’s sustainability dimensions to build a common comprehensive architecture for reporting.

To assess alignment in detail between the <IR> Framework and SASB Standards across all 77 industries, our analysts mapped the 26 categories in SASB’s ‘universe of sustainability issues’ to the <IR> Framework’s capitals using a pairwise, definitions-based methodology. The assessment shows that SASB Standards provide industry-specific guidance for intellectual, human, social and relationship, and natural capital.

Analysts observed that SASB Standards exhibit high alignment with natural, social and relationship, and human capitals. Issues associated with SASB’s business model and innovation, and leadership and governance dimensions generally aligned with more than one integrated reporting capital.

Overall, findings reveal the extent to which SASB sustainability dimensions—and related disclosure topics—provide granular detail on the <IR> Framework’s capitals and a general guide as to which SASB topics and metrics may be most appropriate to include in an integrated report’s discussion of each capital.

With governance and the business model considerations also central to the <IR> Framework, there is clear alignment of focus between the IIRC’s principles-based framework and SASB’s metrics-based standards.

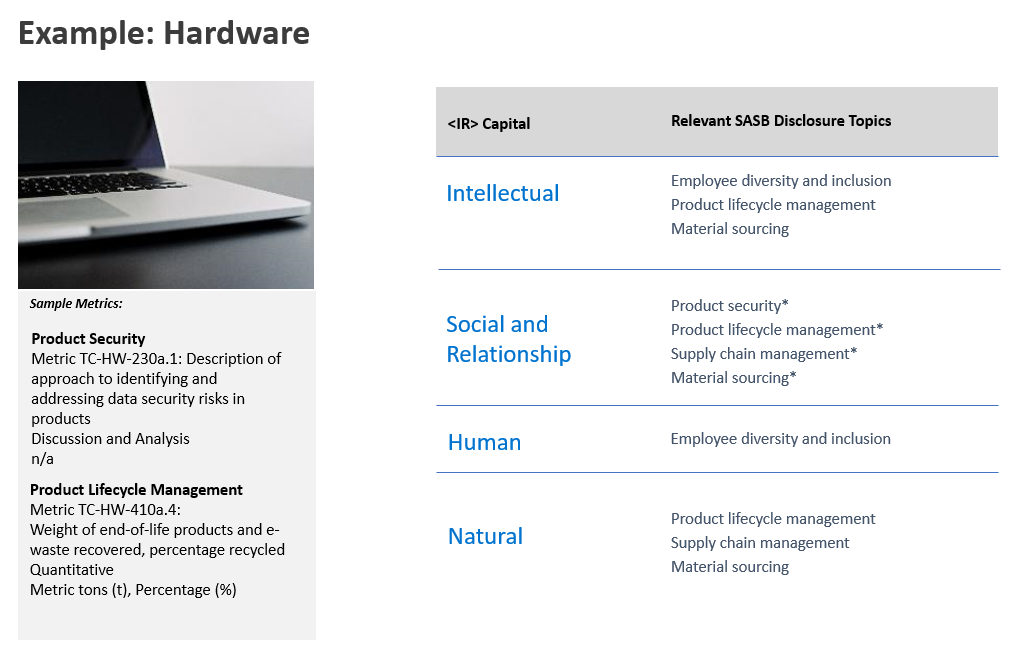

You can access our mapping of the capitals and the sustainability dimensions here, including examples of how this applies to certain industries, such as oil and gas, metals and mining, chemicals, and automobiles. Below is an extract from this mapping – indicating how the disclosure topics within the SASB Standard for Hardware can be mapped to the <IR> Framework’s capitals.

Example Mapping: Hardware

Reporting in action: How Itaú Unibanco uses the <IR> Framework and SASB Standards

Brazil-based Itaú Unibanco, Latin America’s largest private bank, leveraged both the <IR> Framework and SASB Standards, among other international frameworks, to prepare its 2019 annual report. The report uses the concept of the <IR> Framework’s capitals to present the company’s performance highlights, illustrate the advantages of its customer-centric strategy, and discuss how that strategy is realised throughout its operations. Itaú additionally links SASB topics and metrics material to the Commercial Banks industry to key content elements. For example, the company provides complete, assured disclosure of SASB metric FN-CB-550a.1 on Systemic Risk Management, which encourages firms to report their Global Systematically Important Bank (G-SIB) score—a metric used by the Financial Stability Board (FSB) to identify institutions whose failure might trigger a financial crisis. This metric is directly linked to a discussion of Itaú’s risk management model, the specific business activities used to apply this model, and how these activities influence culture at the board and organisational level.

The Value Reporting Foundation

Under the Value Reporting Foundation, which will be formed in the middle of 2021, the International <IR> Framework and SASB Standards will remain complementary tools. The Foundation will facilitate the use of both together and thus better enable organisations to think, plan, and communicate their ability to create value over the short, medium and long term. Combined, the <IR> Framework and SASB Standards provide the 21st century market infrastructure to assess, manage, and communicate long-term value creation strategy and performance.

The IIRC and SASB will host a webinar in April 2021 to share insights into how to use the <IR> Framework with the SASB Standards. Watch out for an invite in your inbox in due course!